The Rules This Social Media Coach Is Living By In Order To Retire By 40

Money Talks is an xoNecole series where we talk candidly to real women about how they spend money, their relationship with money, and how they spend it.

Born Sara Hood in a Sudan refugee camp after her parents escaped a civil war, this Seattle-bred influencer does not show any signs that she has been through any of the hardships she has ever endured. As a mother of two— including a first-born diagnosed with autism— Sara Lovestyle uses the many hats she wears as a mother, wife, advocate, and entrepreneur to demonstrate the true definition of living a "lovestyle", a pseudonym that was born out of her desire to live a life of happiness, wholeness and health.

In this installment of "Money Talks", xoNecole spoke with the 33-year-old social media coach and lifestyle influencer about the importance of investing, generational wealth being the greatest form of wealth, and her worst money mistake of not trusting her gut instinct.

On how much she saves and if it’s in a high-yield savings account:

"When it comes to being an influencer, it took me two years before I started making money and four years before it was significant. I've also discovered it's not so much about what you make (revenue) but what you keep (profit), so I do projections for my business revenue and personal income for a year, along with the budget. I also prioritize what needs to be done to retain a certain level of profit margin, normally at 30 percent, and I believe in saving/investing 20 percent."

On her definitions of wealth and success:

"The greatest form of wealth is generational wealth in the form of financial prosperity you can pass down from one generation to the next. Wealth at its core is also the financial freedom to do what you want to do when you want to do it—creating a prosperity engine where my kids are able to do the same, too…in perpetuity, as T.I. would say (laughs). Success to me is more than just financial freedom. It's the impact I can create and the legacy I can leave.

"Success is evolving to a level of impact where you can empower others. It's being able to start a VC fund for black, brown, and female entrepreneurs because we are so underrepresented and underfunded. Success is all about the tables I can build and fill for others. Whose lives did I touch with my success? Who did I encourage, uplift, impact with my success? Success for oneself leads to a lonely life, and I want so much more than that. Success is not a self-centered pathway to acquiring more clout and material possessions. It's empowering more leaders of excellence and creating the bold audacious change the world needs."

Courtesy of Sara Lovestyle

"Success is all about the tables I can build and fill for others. Success for oneself leads to a lonely life, and I want so much more than that. Success is not a self-centered pathway to acquiring more clout and material possessions. It's empowering more leaders of excellence and creating the bold audacious change the world needs."

On the lowest she’s ever felt when it came to her finances, and how she overcame it:

"In college, I was working at the gas station and at the mall making below minimum wage. I was literally working 16 hours every day while taking a full load of college credit hours. It was rough because I was in sheer survival mode, working whatever hours were necessary to pay rent and stay in school. The interesting thing about the low points when dealing with finances is that they made me scrappy and stronger. It's where my hustle and drive come from. I hustle the same at my lowest and at my highest because to level up from any spot always requires everything you got."

On her biggest splurge to date:

"My biggest splurge is my house. It's where I spend the most time. It's where I raise my children. But the biggest splurge inside my house is the chandelier in my office (laughs). I budgeted for everything, but my chandelier I had to have…because it was a symbol that made me feel like a boss. I love looking up at it because it reminds me to grind and continue to level up…every single day. Success is leased not owned, and rent is due every day."

Courtesy of Sara Lovestyle

On whether she’s a spender or a saver:

"I am a little bit of both. Majority of my splurges are for my business, and I don't consider them splurges; they are investments into my business. If I want to splurge on a purse or shoe I will, but it's planned and calculated if I earned it. If it's a reward, I will. Also, the rule I have is similar to what Jay-Z said. If I can't afford something three times, I don't buy it. If I can buy it once, I consider it a negative, if I can afford it twice, I break even, and if I can afford it three times, then I'm still in the positive.

"Another thing that I do is I plan my finances, my goals, and budgets for my entire year. I break it down to the month, and I have a specific budget each month. I'm blessed as well because my parents made sure to teach me financial literacy starting really young."

"The rule I have is similar to what Jay-Z said. If I can't afford something three times, I don't buy it. If I can buy it once, I consider it a negative, if I can afford it twice, I break even, and if I can afford it three times, then I'm still in the positive."

On the importance of investing:

"It's interesting I went from having never invested to several in a matter of months. Investing has expanded my mind to many experiences and knowledge I would've never gotten in different sectors of business. I invest in financial investments (stocks), and normally put 10 percent of my income toward it. In addition, I make business investments as an angel investor, which I'm most proud of. I invested into Moon UltraLight, an innovative new touch-controlled mobile lighting device designed to clip onto any smartphone or tablet. Its founder is a genius black entrepreneur named Ed Madongorere.

"The number one tip I would give before investing in a business is, you're investing in the person not the business. There could be an exceptional business idea, but if the founder doesn't have a plan of execution or isn't focused, then it won't matter. A recommendation I would also give is to truly study the industry that you're passionate about. Binge on as much information as you can, and then connect with others in the same industry."

On her savings goals and what retirement looks like to her:

"My savings goal is to have three years of emergency savings in reserves. I am intentionally building cash flow systems so that I can be in position to retire in seven years by 40. At that point, my goal is to have built enough cash reserves and investments where I could live off the interest if I wanted to for the rest of my life. At this stage, I imagine [in my] retirement [that I am] still being impactful, so it would be filled with philanthropy, travel, and my family."

Courtesy of Sara Lovestyle

"My savings goal is to have three years of emergency savings in reserves. I am intentionally building cash flow systems so that I can be in position to retire in seven years by 40. At that point my goal is to have built enough cash reserves and investments where I could live off the interest if I wanted to for the rest of my life."

On her budgeting must-haves:

"Before you even make a substantial amount of money, you should always have a budget. It's the foundation to managing your finances. The basics of a budget is you must understand. To the penny. What's coming in or out. What is a necessity (i.e. rent/mortgage) and what's a want? Something I've noticed with even some of my own friends is [people] not paying attention to any subscriptions they have. Sure an app might only be $1.99 or something is $29.99, and something else is only $49.99, but all of that adds up. You have to stay on top of it all with a budget. The same discipline it takes to manage $1,000 is the same it takes to manage $1 million."

On her intentions behind multiple streams of revenue:

"When I created my lifestyle influencer platform, I was initially a make-up stylist and beauty influencer, and make-up styling services became a primary income stream. As I began to pivot and expand, I created income streams for even more influencer passions I have coined a 'Lovestyle' which includes fitness, cooking, and social media influencer coaching. The streams of revenue created for these areas of influence include sponsored social media posts and affiliate marketing, cookbooks, cooking classes, fine dining pop-up events, Belay & Bell Spices — and influencer coaching with my new business partnership with AgencyLuxCo and business partner Taylor Winbush.

"Having only one source as an influencer and entrepreneur isn't smart for me. Social media is a billion-dollar industry. To not have several streams would be doing myself and my audience a disservice, especially because all of my services are tangible, measurable, and scalable resources for others and their businesses."

On unhealthy money habits and mindsets:

"I would say an unhealthy habit is operating with a scarcity mindset. The thought of 'Is it enough?' can be stressful. It can consume you as well as take up precious mental space and energy with worry. I had to understand that to travel far in business and to truly be successful I needed to spend on my team, resources, software, and the things required to make me successful in my businesses. Once I changed my mindset, my businesses began to grow exponentially."

On her money mantra:

"What gets measured gets done."

On the craziest thing she’s ever done for money:

"I'm structured in my personal life, in my business, and I'm certainly structured with my finances. It's rare I'll make random purchases. If it doesn't make sense or if I can do without it, I just won't. The other thing is I rarely buy on trend. That goes for shoes, clothes, furniture—whatever. Even the items in my closet for the most part aren't [trends]. The problem with following trends is that trends change, and trends aren't budget-friendly because you always have to keep up."

On the worst money-related decision she’s ever made:

"The worst money mistakes I've made all happened because I did not follow my instincts. I was presented with a business deal that I didn't feel good about, but I did it to please others I cared about. The structure was wrong, there was no long-term plan, and I didn't trust the business owner completely. Within 90 days, the business collapsed, and I lost all the money I had invested. It makes me sick to my stomach to this day because I didn't trust my instincts that were 100 percent right. Discernment is real, and every mistake I've made is because I didn't listen to my spirit and it always backfired."

On her budget breakdown:

"My budget breakdown for my business is one-third goes back into the business, one-third toward business expenses, and one-third is for me. Keep in mind for a long time I did not take a salary. It was more important to keep my team and put it back into my business. When I teach financial budgeting for influencers, I normally use this breakdown for personal expenses:

Housing: 40%

Auto: 15%

Expenses: 20%

Savings/Investments: 15%

Wants: 10%"For more Sara Lovestyle, follow her on Instagram or visit her official website.

Featured Image Courtesy of Sara Lovestyle

'He Said, She Said': Love Stories Put To The Test At A Weekend For Love

At the A Weekend For Love retreat, we sat down with four couples to explore their love stories in a playful but revealing way with #HeSaidSheSaid. From first encounters to life-changing moments, we tested their memories to see if their versions of events aligned—because, as they say, every story has three sides: his, hers, and the truth.

Do these couples remember their love stories the same way? Press play to find out.

Episode 1: Indira & Desmond – Love Across the Miles

They say distance makes the heart grow fonder, but for Indira & Desmond, love made it stronger. Every mile apart deepened their bond, reinforcing the unshakable foundation of their relationship. From their first "I love you" to the moment they knew they had found home in each other, their journey is a beautiful testament to the endurance of true love.

Episode 2: Jay & Tia – A Love Story Straight Out of a Rom-Com

If Hollywood is looking for its next Black love story, they need to take notes from Jay & Tia. Their journey—from an awkward first date to navigating careers, parenthood, and personal growth—proves that love is not just about romance but also resilience. Their story is full of laughter, challenges, and, most importantly, a love that stands the test of time.

Episode 3: Larencia & Mykel – Through the Highs and Lows

A date night with police helicopters overhead? Now that’s a story! Larencia & Mykel have faced unexpected surprises, major life changes, and 14 years of choosing each other every single day. But after all this time, do they actually remember things the same way? Their episode is sure to bring some eye-opening revelations and a lot of laughs.

Episode 4: Soy & Osei – A Love Aligned in Purpose

From a chance meeting at the front door to 15 years of unwavering love, faith, and growth, Soy & Osei prove that when two souls are aligned in love and purpose, nothing can shake their foundation. Their journey is a powerful reminder that true love is built on mutual support, shared values, and a deep connection that only strengthens with time.

Each of these couples has a unique and inspiring story to tell, but do their memories match up? Watch #HeSaidSheSaid to find out!

Let’s make things inbox official! Sign up for the xoNecole newsletter for love, wellness, career, and exclusive content delivered straight to your inbox.

Feature image screenshot/ xoNecole YouTube

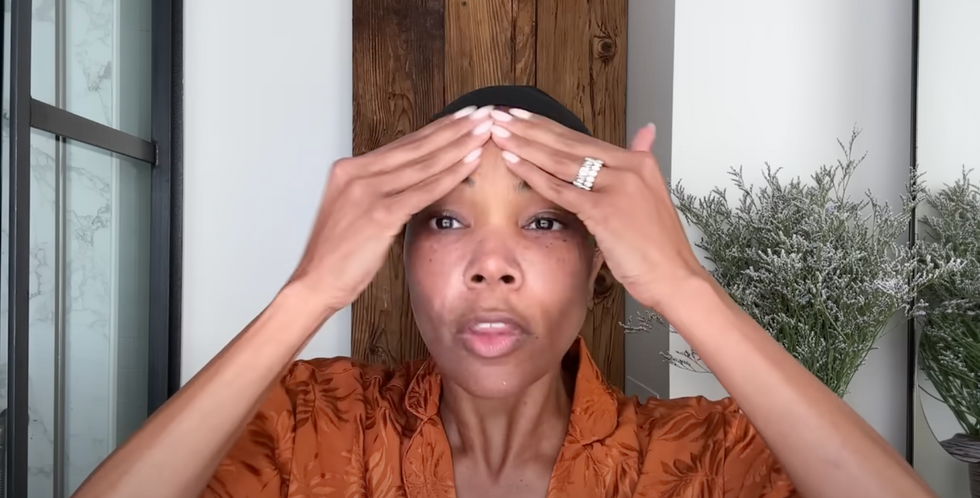

Gabrielle Union Dishes On Her Skincare Journey: 'It's Like Dating, You Just Keep Trying'

Gabrielle Union has always been known for her natural beauty. At 52 years old, she still holds the crown as one of Hollywood's most beautiful actresses and she's spilling her beauty secrets. During Vogue's Beauty Secrets series, the Riff Raff star shares her morning routine, which includes using multiple skincare devices for clear skin to lash serums.

Get all the deets below:

Cleanser

Gabrielle starts with a cleanser from U Beauty and follows that up with witch hazel (toner). "I was really lucky because I never really had crazy, problem skin," she said.

"Not until my hormones changed and it was like, 'is this acne? How do you get acne as a fully-grown ass woman?' But I found a way and I just had to start experimenting."

Exfoliator

Vogue's YouTube/ Screenshot

Next, she uses PCA Skin Pore Refining Treatment for exfoliation. "When I lived in Miami, I was like an oil slick, but in California where it's dry heat--I've also gotten a little dry in my older age," she said. "So I have to switch up my routine based on where I'm at."

The Being Mary Jane star also gave advice to those looking to improve their skincare routine. "If you see someone's skin that you like, 'what are you doing? What are the products? Tell me the routine,'" she shared. "I hope that it works for you, and if it doesn't, it's like dating. You just keep trying."

Retinol

"Some people have very strong opinions about retinol in the daytime, mainly because of the sun. For me it's kinda interchangeable, because I'm psycho about protection from the sun," she explained.

Facial Wands

Vogue's YouTube/ Screenshot

Gabrielle talked about her love for skincare devices. She uses Therabody Theraface Depuffing Wand to help push down the swelling and inflammation around her eyes. She then follows that up with Shani Darden Skin Care Facial Sculpting Wand.

Moisturizer

For moisturizer, she returns to U Beauty. "I started using U Beauty in September. I've never gotten more compliments on my face," she said.

Serum

Vogue's YouTube/ Screenshot

Next is PCA Vitamin B3 Brightening Serum and U Beauty The Return Eye Concentrate. "And with all the things I've used thus far, you have to commit to sunscreen because these products left without any protection from the sun will work against you," she said.

Lash Serums

"I don't know who else out there has a problem with TikTok Shop. I can't stop myself," she said. "The Babe Lash lash serum, the NuOrganic lash serum and I use one on one eye and the other on this one. And I just want to see which one is better."

Sunscreen

For sunscreen, she likes Allies of Skin The One SPF 50 Invisible Sunscreen Gel. "It just disappears right on my face," she said. Shen then ends her skincare routine with Winnie Harlow's Cay Skin Isle Lip Balm SPF 30.

Let’s make things inbox official! Sign up for the xoNecole newsletter for love, wellness, career, and exclusive content delivered straight to your inbox.

Feature image Vogue's YouTube/ Screenshot